After the elections held on 25th of January this year, Tsipras’s SYRIZA finally had a chance to take Greece back to its bright days initiated with joining the European Union (EU). In his 5 months long governing period, it is possible to say that sky is not clear yet. Even though there were significant promises during the election campaigns, SYRIZA could not help but face with the reality of Troika, triangle of International Monetary Fund (IMF), European Central Bank (ECB) and European Commission (EC). Still, according to the recent polls, Greeks are still confident in Tsipras and his decisions. And indeed, opposition parties have been patiently (recently not) waiting their chances to prove that Greece could actually survive from this nightmare. Or there will be a solution?

Let’s have a quick look on Greece’s current government structure. Current government was formed by SYRIZA as the leading party working together with The Independent Greeks (ANEL) while New Democracy (ND), Golden Dawn (XA), The River (To Potami) The Communist Party of Greece (KKE) and The Panhellenic Socialist Movement (PASOK) took seats as opposition parties. Still, SYRIZA controls the significant decisions – making ministries in both interior and foreign policy, so that it is safe to refer economic progress of Greece in January – June period as a result of Tsipras’s decisions.

There are already rumors that Tsipras might ask for an early election, since it seems recent talks with EC and IMF do not lead to anywhere. Varoufakis, Greek Economy Minister, expressed that Greece will not be able to pay latest debts to the Troika which was not supported by Lagarde, the head of IMF.

Here is the schedule for Greek debts which lasts until 2054. Critical ones are marked grey as debts to Treasury bill holders, red as to IMF and blue as to ECB. Greece owes € 131 billion to European Financial Stability Facility, € 53 billion to Eurozone Governments, € 34 billion to Private Investors, € 27 billion to ECB, € 21 billion to IMF and € 15 billion to Treasury Bill Holders with a total of € 281 billion. Debt to European Investment Bank is neglected due to its amount comparing with others (€ 25 million to be paid in July).

Recently, talks between Greece and Troika are likely to end without a resolution and these three months could be the most dangerous ever to Greek economy. As a reminder, during June – August period, Greece will pay € 7 billion to TBH, € 2 billion to IMF and € 5.63 billion to ECB.

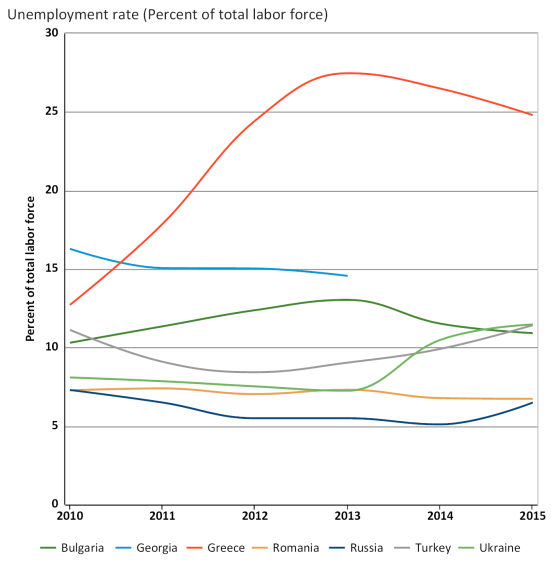

Greek unemployment has been stable: the 25.6% of unemployment rate stays unchanged during Tsipras’s government. Beside the debt, unemployment is the biggest problem Greece has been fighting with since 2009. SYRIZA managed to stop the increase trend of unemployment but could not accomplish to decrease it either. Youth unemployment rate is still around 50%, one of the worst with Spain in EU.

What about stock market response? Athens Stock Exchange (ASE:IND) had ups and downs last month and closed the mid June with 733.24 which was around 850.00 when SYRIZA took in charge. Foreign investors are leaving the market and destabilization in both € and $ also threatens investors in Greece.

Greek long term interest rates rose since January and reached its peak (13.6%) in April. When Tsipras formed the government, it was 9.09%.

Greece sovereign credit ratings according to S&P’s, Moody’s and Fitch are CCC, Caa2 and CCC, respectively, which all indicate “lower than investment grade”. Foreign Direct Investment (FDI) in Greece decreased to € -68.70 million in March of 2015 from € 4.70 million in February of 2015. FDI in September was € 4.5 million and increased continuously to € 216.9 million in January when SYRIZA started. But at the end of March, Greece saw the bottom in terms of FDI.

To sum up, both economies and politicians focus on the negotiations between Greece and Troika. Good sign (means delaying debts) also delays the possibility Greek default, and maybe the bigger crises further in both economic and social issues. And the bad sign? Well, frankly, most of EU leader, European investors and Greek politicians would not desire it at this very fragile time.

Last but not least, an early election - indeed, it is possible. PASOK has a new leader, Fofi Gennimata, and the party will strive to find a way to rule Greece as they did five years ago with Papandreou, or ND did with Samaras, who was the former Prime Minister and had to step down after the elections.

All eyes are on Tsipras’s performance right now. We will have some answers until the end of these three months, or maybe in this very June, to know if Greece sees a light at the end of the tunnel or not.